北京大学国家发展研究院研究生导师林双林

北京大学国家发展研究院研究生导师林双林内容如下,更多考研资讯请关注我们网站的更新!敬请收藏本站,或下载我们的考研派APP和考研派微信公众号(里面有非常多的免费考研资源可以领取,有各种考研问题,也可直接加我们网站上的研究生学姐微信,全程免费答疑,助各位考研一臂之力,争取早日考上理想中的研究生院校。)

微信,为你答疑,送资源

北京大学国家发展研究院研究生导师林双林 正文

现任职务

国家发展研究院 教授

北京大学中国公共财政研究中心 主任

研究领域

公共经济学,中国财政,经济增长

教育背景

北京大学,经济学学士, 1982年1月(77级)

美国,经济学硕士, 1984

美国普度大学,经济学博士, 1989

工作经历

2005-2013 北京大学经济学院教授、财政系主任

2008- 中国财政学会理事

2007- 北京大学中国公共财政研究中心主任

2006- 美国奥马哈内布拉斯加大学Noddle Distinguished讲座教授

2002-2003 中国留美经济学会会长

2002- 国立新加坡大学东亚研究所客座研究员

2000-2006 美国奥马哈内布拉斯加大学Lindley讲座教授

1997-1998 中国留美经济学会副会长

1996 北京大学中国经济研究中心访问研究员

1989-2000 美国奥马哈内布拉斯加大学助理教授,副教授,教授

英文杂志论文选

1. 公共财政,经济增长:

“Skill Distribution and the Optimal Marginal Tax rate,” co-authored with J. Li and C. Zhang, Economics Letters, Vol. 118, January (1st Quarter/Winter) 2013, 515–518.

“Existence and Uniqueness of Steady-State Equilibrium in a Generalized Overlapping Generations Model,” co-authored with J. Li, Macroeconomic Dynamics, Vol. 16 (Supplement 3), 2012, 299–311.

“The Effect of Corruption on Capital Accumulation,” with W. Zhang, Journal of Economics, Vol. 97, 2009, 67-93.

“Existence and Uniqueness of Steady-State Equilibrium in a Two-sector Overlapping Generations Model,” co-authored with J. Li, Journal of Economic Theory, Vol. 141, 2008, 255–275.

“On the Existence of Nash Equilibrium for Infinite Matrix Games," co-authored with J. Li and C. Zhang, Journal of Nonlinear Analysis: Real World Application,” 2008.

“China's Capital Tax Reforms in an Open Economy,” Journal of Comparative Economics, Vol. 31, 2004, 128-147.

“Population Growth and Social Security Financing,” Journal of Population Economics, Vol. 16, 2003, 91–110.

“The Effect of Public Transfers on Physical and Human Capital Accumulation,” Public Finance Review, Vol. 31, No. 6, 2003, 649-669.

“Government Debt and Economic Growth,” co-authored with Kim Sosin, Economics of Transition, Vol. 9, No. 3, 2001, 635-655.

“Taxation, Human Capital Accumulation, and Economic Growth,” Japanese Economic Review, Vol. 52, No. 2, June 2001, 185-197.

“Government Debt and Economic Growth in an Overlapping Generations Model,” Southern Economic Journal, Vol. 66, No. 3, January 2000, 754-763.

“Tax Reform and External Balance,” Journal of International Money and Finance, Vol. 18, No. 6, October 1999, 891-909.

“Resource Allocation and Economic Growth in China,” Economic Inquiry, Vol. 38, Number 3, 2000, 515-526.

“Labor Income Taxation and Human Capital Accumulation,” Journal of Public Economics, Vol. 68, May 1998, 291-302.

"Government Education Spending and Human Capital Accumulation," Economics Letters, Vol. 61, December 1998, 391-393.

“Taxing Consumption in an Open Economy,” Public Finance Review (Formerly Public Finance Quarterly), Vol. 26, No. 3, May 1998, 250-269.

“Capital Taxation and External Accounts in a Small Growing Economy," Review of International Economics, Vol. 9, No. 1, January 1998, 59-73.

“Welfare Effects of Capital Taxation in a Small Open Economy," co-authored with Wei Zhang, Open Economies Review, Vol. 9, No. 1, January 1998, 5-20. “Welfare Effects of Capital Taxation," Public Finance/Finances Publiques, co-authored with Yong Shi, Vol. 49, 1994, 391-408.

“Budget Deficits, Time Preference, and the External Deficits," Economic Studies Quarterly, Vol. 45, No. 4, December 1994, 289-305.

“Capital Taxation and Accumulation in a Growing World Economy with Deficit Finance," International Tax and Public Finance, Vol. 1, No.2, 1994, 127-146. “Government Debt and the Real Exchange Rates in an Overlapping Generations Model," Journal of International Economic Integration, Vol. 9, No. 1, March 1994, 94-105.

“Allocation of Government Spending and Economic Growth," Economic Notes, Vol. 23, No. 1, 1994, 130-141.

“Government Expenditures, Demographic Changes, and Economic Growth," co-authored with Bun Song Lee, International Economic Journal, Vol. 8, No. 1, Spring 1994, 91-108.

“Government Budget Deficits and the Real Interest Rate,” Hong Kong Economic Papers, 1994.

“The Differential Effects of Government Expenditures on Economic Growth,” co-authored with Donald Baum, Journal of Economic Development, Vol.18,No. 1 1994, 175-185.

2. 中国经济:

“Is There Any Gain from Social Security Privatization?” co-authored with S. Li, China Economic Review, Vol. 21, No. 3, September 2011, 282-293.

“The Size and Structure of China’s Government Debt,” co-authored with S. Li, Journal of Social Sciences, Vol. 48, No. 3, September 2011,527.

“Tax Reforms in China and Russia,” The Chinese Economy, Vol. 42, No. 3, 2009, 24-40.

“Solving the Renminbi Problem and China’s External Imbalance: A Structural and Institutional Perspective on Inflation, Appreciation, and Reform: A Comment,” Asian Economic Papers, 2009.

“China's Value-Added Tax Reform, Capital Accumulation, and Welfare Implications,”China Economic Review, Vol. 19, 2008, 197-214.

“FDI Technology Spillovers Within And Across Industries: Evidence From China,” co-authored with X. Tian, Journal of Asia Business Studies, 2009, 29-36.

“Forced Savings, Social Safety Net, and Family Support: a New Old-age Security System for China,” The Chinese Economy, vol. 41, No. 6, 2008, 10–44. terminants of the Profitability of China’s Regional SOEs,” co-authored with Wei Rowe, China Economic Review, 2006.

“The Excessive Fee Collections in China: Reasons, Consequences, and Strategies,” Contemporary Economic Policy, Vol. 23, No. 1, January, 2005, 91-106.

“China's Government Debt: How Serious?” China: An International Journal, Vol. 1, No. 1, 2003, 73-98.

“Urban Economic Growth in China: Theory and Evidence,” co-authored with Shunfeng Song, Urban Studies, Vol. 39, No. 12, 2002, 2251-2266, November 2002.

“Public Infrastructure Development in China,” Comparative Economic Studies, Vol. 38, Summer, 2001, 83-109.

“The Decline of China’s Budgetary Revenue: Reasons and Consequences,” Contemporary Economic Policy, Vol. 27, Number 4, 2000, 477-490.

“Foreign Trade and China’s Economic Development: A Time-Series Analysis,” Journal of Economic Development, Vol. 25, Number 1, June 2000, 145-153.

“Export Expansion and Economic Growth: Evidence from Chinese Provinces,” Pacific Economic Review, Vol. 4, No. 1, February 1999, 65-77.

“The Effect of an Expansion of Pay-As-You-Go Social Security System in China,” International Journal of Economic Development, Vol. 1, No. 4, 1999.

“Education and Economic Development in China,” Comparative Economic Studies, Vol. 36, No. 3&4, December 1997, 66-85.

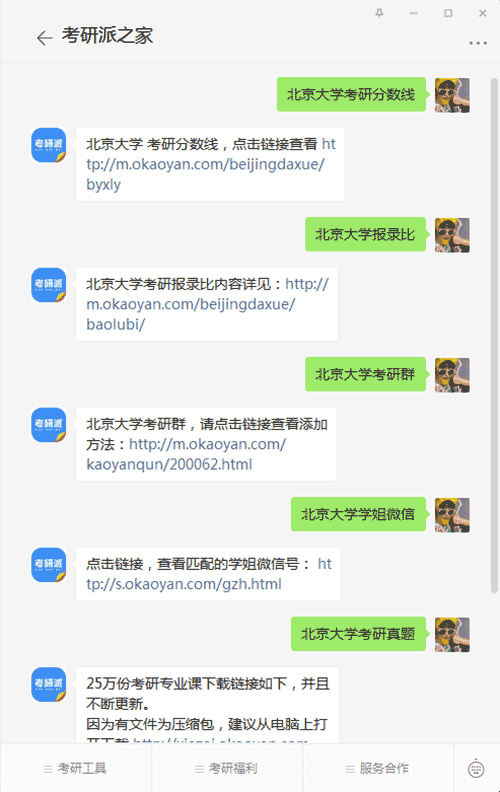

添加北京大学学姐微信,或微信搜索公众号“考研派小站”,关注[考研派小站]微信公众号,在考研派小站微信号输入[北京大学考研分数线、北京大学报录比、北京大学考研群、北京大学学姐微信、北京大学考研真题、北京大学专业目录、北京大学排名、北京大学保研、北京大学公众号、北京大学研究生招生)]即可在手机上查看相对应北京大学考研信息或资源。

北京大学

本文来源:http://www.okaoyan.com/beijingdaxue/daoshi_113981.html

推荐阅读

-

北京大学经济学院金融学系导师介绍:冯科

姓名:冯科……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:崔巍

姓名:崔巍……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:赵留彦

姓名:赵留彦……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:宋芳秀

姓名:宋芳秀……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:谢世清

姓名:谢世清……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:李连发

姓名:李连发……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:冯晴

姓名:冯晴……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:刘宇飞

刘宇飞……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:吕随启

姓名:吕随启……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:王曙光

姓名:王曙光……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:施建淮

姓名:施建淮……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:王一鸣

姓名:王一鸣……

日期:02-19 阅读量:20 -

北京大学经济学院金融学系导师介绍:胡坚

姓名:胡坚……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:宋敏

宋敏,经济学院教授、金融系主任……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:何小锋

姓名:何小锋……

日期:01-30 阅读量:20 -

北京大学经济学院金融学系导师介绍:李庆云

姓名:李庆云……

日期:01-30 阅读量:20 -

北京大学光华管理学院金融学研究生导师介绍:

曹凤岐……

日期:01-30 阅读量:20 -

北京大学国家发展研究院金融学专业研究生导师

国家发展研究院……

日期:01-30 阅读量:20 -

北京大学国家发展研究院研究生导师介绍:余淼

工作经验副教授中国经济研究中心助教授北京大学中国经济研究中心客座助理教授香港大学经济及金融学院讲师美国加利福尼亚大学戴维斯校经济系学术兼职英国诺丁汉大学全球经济政策研究中心……

日期:01-30 阅读量:20 -

北京大学深圳医院研究生导师李环

李环性别:女职称:主任医师科室:妇产科专家简介:李环,妇产科,主任医师,硕士生导师,中山医科大学(六年制)医疗系毕业,全国盆底网专家库成员,深圳市继续教育中心兼职教授,国际……

日期:08-20 阅读量:20