宁波大学商学院导师:章勇敏

宁波大学商学院导师:章勇敏内容如下,更多考研资讯请关注我们网站的更新!敬请收藏本站,或下载我们的考研派APP和考研派微信公众号(里面有非常多的免费考研资源可以领取,有各种考研问题,也可直接加我们网站上的研究生学姐微信,全程免费答疑,助各位考研一臂之力,争取早日考上理想中的研究生院校。)

微信,为你答疑,送资源

宁波大学商学院导师:章勇敏 正文

[导师姓名]章勇敏

[所属院校]

宁波大学

[基本信息]

导师姓名:章勇敏

性别:男

人气指数:3839

所属院校:宁波大学

所属院系:商学院

职称:教授

导师类型:硕导

招生专业:金融学、数量经济学

研究领域:衍生品定价

[通讯方式]

电子邮件:yminzhang27@163.com

[个人简述]

章勇敏教授于1997年获得美国芝加哥大学博士学位,曾在美国芝加哥大学与纽约州立大学从事17年的教学研究,并作为摩根大通的首席研究员及富国银行的风险管理顾问,在美国华尔街从事3年的金融模型开发工作。2009年,担任西交利物浦大学博导兼江苏省“青蓝工程” 学术带头人。 2011年, 担任宁波诺丁汉大学金融学首席教授, 兼国际金融研究中心主任与金融系主任,2012年起担任浙江省高校重点学科“全球金融管理”学术带头人。他作为金融系创建主任, 向全球引进6名优秀金融教授与博士, 为宁波诺丁汉大学的金融与管理专业获得宁波品牌专业的称号并获得政府50万的学科建设经费。他共培养了2名博士后, 7名博士, 39名硕士, 其中3名在美国著名高校担任教授。2018年,担任宁波大学商学院金融学教授, 兼“应用经济学”学科带头人, 同时担任“一带一路”研究院副院长。章教授在金融、管理、经济、数学、物理等多个领域取得重要成果, 共出版了2部专著,撰写80多篇论文,其中17篇文章发表于影响因子在1.0以上的SCI/SSCI国际期刊,12篇文章发表于影响因子在2.0以上的SCI/SSCI国际期刊,2篇文章发表于影响因子在3.0以上的SCI/SSCI国际期刊,1篇文章发表于影响因子为5.9的排名前15的SCI科学期刊。他主持了10多个大型研究课题,并获得中国国家自然科学基金、中国社会科学院、美国能源部、英国外交部等机构的2千万科研经费的支持。他组织了6次大型金融国际会议, 并获得了2百万来自政府与业界的赞助。应邀在国际学术会议及著名学术机构发表60多次的主旨演讲。并担任了国际金融与银行学会2017亚洲年会的大会主席及第六届期货与衍生品国际学术论坛主席。他多次应邀担任各级政府与多个机构的学术委员会成员、专家组成员及智囊顾问。多次接受国内外著名媒体的采访与报道。他是国际著名金融期刊《Journal of Futures Markets》与《Emerging Markets Finance and Trade》的客座主编及《International Journal of Social Science and Management》的副主编。同时,也在国际顶级金融期刊《Journal of Banking and Finance》、《Quantitative Finance》及《Journal of Futures Markets》等担任论文评审。章教授获得的荣誉包括:法国UAP数学奖、香港王宽城基金会学者、美国第十一届应用数学年会杰出论文奖、美国纽约州立大学个人发展奖、美国名人录、中国教育部“海外高层次人才”称号。

[科研工作]

主要著作和论文:Papers in Finance, Management, and Economics Papers under Review1. “Sharp Sensitivity Bounds for Bounds for American Options with General Payoff Functions”, submitted, Journal of Political Economy, (top 5 economic journal), 2017. (SSCI, ABS 4*)2. “Searching Optimal Exercising Boundaries in Perpetual American Options”, submitted, American Economic Review, (top 5 economics journal), 2017. (SSCI, ABS 4*)3. “Pricing Liquidity into Futures”, submitted, Journal of Finance, (top 3 finance journal), 2017, (with S. Ding and D. Newton). (SSCI, ABS 4*)4. “The Impact of Real Asset Illiquidity on Investment: Extending Real Options Theory with Asset Illiquidity”, submitted, Review of Economic Studies, (top 5 economics journal), 2017, (with S. Ding and E. Scheffel). (SSCI, ABS 4*)5. “Liquidity Effects on Prices and Returns Co-movement and Co-integration in Commodity Futures Markets”, submitted, Journal of Banking and Finance, 2017, (with S. Ding, M. Duygun, and M. Shaban). (ranked No.5 in finance journals by impact factor), (SSCI, ABS 3*)6. “Derivatives Pricing with Liquidity Risk: Validation in Futures Markets”, submitted, Journal of Banking and Finance, 2017, (with S. Ding, and M. Duygun). (ranked No.5 in finance journals by impact factor), (SSCI, ABS 3*)7. “Portfolio selection and dynamic behavior in Heston's stochastic volatility model using a contingent claim”, submitted, Journal of Banking and Finance, 2017, (with A. Zhang, Y. Zhao, D. Borgia). (ranked No.5 in finance journals by impact factor), (SSCI, ABS 3*)8. “Forecasting Oil Volatility with Liquidity Effects: A Generic Programming Based Method”, submitted, Journal of Banking and Finance, 2017, (with S. Ding, T. Cui, and M. Shaban). (ranked No.5 in finance journals by impact factor) , (SSCI, ABS 3*)9. “Commodity Price Co-movements and Liquidity Commonality”, R&R, Economic Modeling, 2017, (with S. Ding). (SSCI, ABS 2*)10. “Modeling Price Volatility based on a Genetic Programming Based Method”, R&R, British Journal of Management, 2018, (with S. Ding, M. Duygun, and V. Sena). (SSCI, ABS 4*) Papers in Refereed Journals11. Y. Zhang, S. Ding, and E. Scheffel, “Policy Impact on Volatility Dynamics in Commodity Futures Markets: Evidence from China”, forthcoming, https://doi.org/10.1002/fut.21905, Journal of Futures Markets, 2018. (the leading journal in futures and derivatives markets), (2016 Impact Factor 1.29), (SSCI, ABS 3*)12. Y. Zhang, S. Ding, “The Return and Volatility Co-movement in Commodity Futures Markets: The Effects of Liquidity Risk”, forthcoming, https://doi.org/10.1080/14697688.2018.1444562, Quantitative Finance, 2018. (the leading journal in quantitative finance), (2016, 5 year Impact Factor 1.06), (SSCI, ABS 3*)13. Y. Zhang, X. Shen, “Study on Financing Channels of Shipping Companies in China”, ICTACT Journal on Management Studies, Vol 03, No. 2, 531-537, May, 2017.14. Y. Zhang, X. Shen “Suggestions for Improving Profitability and Competitiveness of Shipping Companies in China”, ICTACT Journal on Management Studies, Vol 02, N0. 2, 312-321, May, 201615. Y. Zhang, W. Liu “Policy Analysis and Recommendations on Using Renewable Energy for Generating Electricity”, Environment Protection, Vol.44, No.05, 41-46, 2016.(Managed by Chinese Ministry of Environment Protection, with the largest circulation in environmental science in China).16. Y. Zhang, K. Zhou, W. Tu, X. Shen, and J. Tang “Policy Suggestions on the Development of Sci-Tech Finance in Zhejiang, China”, ICTACT Journal on Management Studies, Vol 1, No. 2, 63-73, May, 201517. Y. Zhang, W. Liu “Some Recommendations for Improving Renewable Energy Policies in China”, Management Studies, Vol 3, No. 3-4, 110-128, April 201518. Y. Zhang, X. Shen “The Strategies for Market Risk Management in International Shipping”, Management Studies, Vol 2, No. 7, 447-464, July 201419. Y. Zhang, X. Shen “Studies on market risk management strategies in shipping companies”, World Shipping, Vol 37, 233, 6-11, 2014.(Managed by Chinese Ministry of Transportation, with the largest circulation in shipping science in China).20. Y. Zhang, X. Shen, H. Feng, and L. Xu “Improving Competitiveness in Shipping Industry in Zhejiang through the Development of Shipping Finance”, Zhejiang Finance, 2, 75-79, 2014.21. Y. Zhang “Policy Recommendations for Zhejiang Shipping Finance”, Overseas Scholars, 13, 54-56, October, 201422. Y. Zhang, W. Tu, and A. Shen, “The prospect of Sci-Tech Finance in Ningbo”, Ningbo Finance, 3, 64-70, 2013.23. R. Liu and Y. Zhang, “Portfolio Management for Assets with Multiscale Risk Structure”, Journal of Coupled System and Multiscale Dynamics, Vol 1, 1, 1-13, 2013.24. P. Chen, Z. Lin, Y. Liu, and Y. Zhang, “Has Real Estate Come of Age?”, Journal of Real Estate Portfolio Management, Vol. 17, 3, 243-254, 2011.(A leading journal published by American Real Estate Society)25. Y. Zhang, “Mortgage Backed Securities Valuation and Risk Hedging”, Journal of Risk Management, 10, pp. 94-103, 2010. Books26. Y. Zhang, “Steady Economic Growth and Financial Innovation”, China Finance Publishing House, 2013. (the leading publisher in finance in China)27. Y. Zhang, “Finance and Investment in Marine Economy”, China Finance Publishing House, 2015. (the leading publisher in finance in China) Refereed Publications in Conference Proceedings28. R. Liu, X. Li, and Y. Zhang, “Mixed Portfolio Allocation with Real Estate Asset in Chinese Market”, The Second Conference of Ningbo-Nottingham International Finance Forum Paper Series, China Finance Publishing House, 2013.29. Y. Zhang, “Risk Management for Mortgage Pipeline”, The Inaugural Conference of Ningbo-Nottingham International Finance Forum Paper Series, pp. 350-357, Economics Science Press, 2011.30. Y. Zhang, “Pricing and Risk Management for Mortgage Backed Securities”, Proceeding of First China Forum on Financial Product Investment and Risk Management, pp. 60-79, 2010.31. Y. Zhang, “Hedging Mortgage Pipeline Risk using Capital Market Instruments”, Proceeding of First China Forum on Financial Product Investment and Risk Management, pp. 344-358, 2010.32. Y. Zhang, “Some Non-arbitrage Properties in Numerical Solutions for American Options”, Proceeding of SIAM Conference on Financial Mathematics and Financial Engineering, 26, 2010.33. Y. Zhang, “American Option Pricing Model as an Obstacle Problem,” Proceeding of SIAM Annual Meeting, 2010. Papers in Wells Fargo Internal Research34. Y. Zhang, D. Key, D. Sweeney, and J. Ahlart “A New Fallout Model for Mortgage Pipeline Valuation,” Capital Market Finance Document, Wells Fargo, 2010.35. Y. Zhang and D. Key “An Alternative Method for Valuing Hedge Cost Variability,” Capital Market Finance Document, Wells Fargo, 2010.36. Y. Zhang “Transition Probabilities between Statuses for Rate Locks,” Capital Market Finance Document, Wells Fargo, 2010.37. Y. Zhang “Reverse Mortgage Cash Flow Modeling,” Capital Market Finance Document, Wells Fargo, 2009.38. Y. Zhang “Look back options with hurdle adjustment,” Capital Market Finance Document, Wells Fargo, 2009.39. Y. Zhang “ADCO Prepayment Model Tuning for Quantitative Risk Management (QRM) System,” Capital Market Finance Document, Wells Fargo, 2009.40. Y. Zhang “Comparative Study for Black-Karasinski model and Hull-White model within QRM framework,” Capital Market Finance Document, Wells Fargo, 2009. Papers in J. P. Morgan Internal Research41. Y. Zhang “Valuation and Hedging for Mortgage Backed Securities,” Capital Market Research Report, J. P. Morgan, 2008.42. Y. Zhang “Prediction Models for Daily MSR Portfolio Values,” Capital Market Research Report, J. P. Morgan, 2008.43. Y. Zhang “Hedging Strategies for Mortgage Servicing Rights,” Capital Market Research Report, J. P. Morgan, 2008.44. Y. Zhang “Multifactor Libor Market Interest Rate Models Calibration,” Capital Market Research Report, J. P. Morgan, 2008.45. Y. Zhang “WaMu Loan Level Mortgage Prepayment Models,” Capital Market Research Report, J. P. Morgan, 2007.46. Y. Zhang “WaMu Pool Level Mortgage Prepayment Models,” Capital Market Research Report, J. P. Morgan, 2007.47. Y. Zhang “Swap based Mortgage Index Models,” Capital Market Research Report, J. P. Morgan, 2007.48. Y. Zhang “Mean-reversion Mortgage Spread Models,” Capital Market Research Report, J. P. Morgan, 2007. Non-Refereed Papers, Report and Other Articles:49. Y. Zhang, Y. Guo, W. Tu, and X. Shen, “A Study on Strategies for Perfecting Chinese Sci-Tech Finance System”, Chinese Fintech Policy Paper, 2014.50. Y. Zhang, “Study on Strategies for Development of Zhejiang Shipping Finance,” Zhejiang Government Policy Paper, 2013.51. Y. Zhang, Z. Yang, W. Tu, and A. Shen, “A Report on Shanghai Sci-Tech Finance,” Ningbo Government Policy Paper, 2011.52. Y. Zhang, Z. Yang, W. Tu, and A. Shen, “Construction of Ningbo Sci-Tech Finance System,” Ningbo Government Policy Paper, 2011.53. P. Cheng, Z. Lin, Y. Liu, and Y. Zhang, “The Real Estate Allocation Puzzle: Factor or Fiction,” J. of Portfolio Management, under review, also available in Social Science Research Network (http://ssrn.com/abstract=1583952), 2010.54. Y. Zhang, “A Non-arbitrage Condition on Payoff Functions for American Option,” preprint, 2010.55. P. Cheng, Z. Lin, Y. Liu, and Y. Zhang, “Serial Persistence and Holding Period Dependence of Real Estate Risk,” preprint , 2010. Papers in Applied Mathematics, and Computational Science Papers in Refereed Journals56. Y. Zhang, “A two-dimensional flame tracking algorithm with application to type Ia supernova,” Nonlinearity, 22, 1909-1925, 2009. (2016 SCI Impact Factor 1.767)57. Y. Zhang, “Convergence of Free Boundaries in Discrete Obstacle Problems,” Numerische Mathematik, 106:157-164, 2007. (2016 SCI Impact Factor 2.152, one of top 3 journals in computational mathematics)58. Y. Zhang, “Monotone Convergence of Finite Element Approximation of Obstacle Problems,” Applied Mathematics Letters, 20, 445-449, 2007.(2016 SCI Impact Factor 2.233)59. Y. Zhang, R. P. Drake, J. Glimm, J. W. Grove, and D. H. Sharp, “Radiation Coupled Front Tracking Simulations for Laser Driven Shock Experiments,” Nonlinear Analysis, 63/5-7, pp. e1635-e1644, 2005. (5 Year SCI Impact Factor 2.268)60. S. Dutta, E. George, J. Glimm, J. Grove, H. Jin, T. Lee, X. Li, D. H. Sharp, K. Ye, Y. Yu, Y. Zhang, and M. Zhao, “Shock Wave Interactions in Spherical and Perturbed Spherical Geometries,” Nonlinear Analysis, 63/5-7, pp. 644-652, 2005. (5 year SCI Impact Factor 2.268)61. S. Dutta, J. Glimm, J. W. Grove, D. H. Sharp, and Y. Zhang, “Spherical Richtmyer-Meshkov instability for axisymmetric flow,” Mathematics and Computers in Simulation, 65 (2004) 417-430. (5 year SCI Impact Factor 1.308)62. S. Dutta, J. Glimm, J. W. Grove, D. H. Sharp, and Y. Zhang, “Error Comparison in Tracked and Untracked Spherical Simulations,” Computers & Mathematics with Applications, 48, 1733-1747, 2004. (5 year SCI Impact Factor 2.008)63. Y. Zhang, “Error Estimates for the Numerical Approximation of Time-dependent Flow of Bingham Fluid in Cylindrical Pipes by the Regularization Method,” Numerische Mathematik, Vol 96, No. 1, 153-184, 2003. (2016 SCI Impact Factor 2.152, one of top 3 journals in computational mathematics)64. S. Dutta, J. Glimm, J. W. Grove, D. H. Sharp, and Y. Zhang, “A Fast Algorithm for Moving Interface Problems,” Lecture Notes in Computational Science 2668: 782–790, 2003.65. J. Glimm, H. Jin, M. Laforest, F. Tangerman, and Y. Zhang, “A Two Pressure Numerical Model of Two Fluid Mixtures,” Multiscale Modeling and Simulation, 1:458-484, 2003. (5 year SCI Impact Factor 2.154, the leading journal in multiscale science)66. J. Glimm, J. W. Grove, and Y. Zhang, “Interface Tracking for Axisymmetric Flows,” SIAM J. Sci. Comp., Vol 24, No. 1, 208-236, 2002. (5 year SCI Impact Factor 2.803, the leading journal in scientific computing)67. Y. Zhang, “Multilevel Projection Algorithm for Obstacle Problems,” Computers and Mathematics with Applications 41 (2001) 1505-1513. (5 year SCI Impact Factor 2.008)68. Y. Zhang, “A Posterior Error Analysis of a Two-level Scheme for Solving the Obstacle Problem,” INFORMATION, Vol. 3, No. 4, 469-477, October 2000. Non-Refereed Papers, Report and Other Articles:69. Y. Zhang, “Monotonicity and Stability of Numerical Solutions for Obstacle Problems,” Preprint, 2006.70. Y. Zhang, “Numerical Solution of Variational Inequalities,” Ph.D thesis, University of Chicago, 1997.71. Y. Zhang, “Implementation of MA Prediction Algorithm,” Applied Science Laboratory, GE Medical Systems, 1997.72. Y. Zhang, “File Structure and Operation Manual for CT/i Implementation of MA Prediction Algorithm,” Applied Science Laboratory, GE Medical Systems, 1997.73. Y. Zhang, “A Monotonicity Principle and L∞-Error Bound for a Discrete Obstacle Problem,” Technical Report (TR-96-21), University of Chicago, 1996. Papers in Physics, and Mechanical and Chemical Engineering Science Papers in Refereed Journals74. Y. Zhang, R. P. Drake, and J. Glimm, “Numerical Evaluation of Impact of Laser Preheat on Interface Structure and Instability,” Physics of Plasmas, 14, 062703, 2007.(2016 SCI Impact Factor 2.115, the leading journal in Plasma Physics)75. Z. Xu, J. Glimm, Y. Zhang, and X. Liu, “A Multiscale Front Tracking method for Compressible Free Surface Flows,” Chemical Engineering Science, 62 (13): 3538-3548, 2007. (5 year SCI Impact Factor 3.077)76. Y. Zhang, J. Glimm, and S. Dutta, “Tracked Flame Simulation for Type Ia Supernova,” Computational Fluid and Solid Mechanics, 950-953, 2005.77. Y. Zhang, J. Glimm, and R. P. Drake, “Modeling and Simulation of Fluid Mixing for Laser Experiments and Supernova,” Bulletin of American Physical Society, Vol. 50, No. 9, pp. 178, 2005.78. J. Glimm, H. Jin, and Y. Zhang, “Front Tracking for Multiphase Fluid Mixing,” Computational Methods in Multiphase Flow, 2, pp. 13-22, 2004.79. R. P. Drake, H. F. Robey, O. A. Hurricane, Y. Zhang, B. A. Remington, J. Knauer, J. Glimm, D. Arnett, J. O. Kane, K. S. Budil, J. W. Grove “Experiments to produce a hydrodynamically unstable spherically diverging system of relevance to instabilities in supernovae,” Astrophysical Journal, Vol. 564, 2, 896-908, 2002. (2015 SCI Impact Factor 5.909, the leading journal in Astrophysics)80. J. Glimm, J. W. Grove, Y. Zhang, and S. Dutta, “Numerical Study of Axisymmetric Richtmyer-Meshkov Instability and Azimuthal Effect on Spherical Mixing,” J. Stat. Physics, Vol. 107, nos 112, 241-260, 2002.(2015 SCI Impact Factor 1.537, the leading journal in Statistical Physics)81. J. Glimm, J. W. Grove, and Y. Zhang, “Three Dimensional Axisymmetric Simulations of Fluid Instabilities in Curved Geometry,” Advances in Fluid Mechanics, 3, 643-652, 2000. Refereed Publications in Conference Proceedings82. Y. Zhang “Numerical Measurement of Impact of Laser Preheat in Laboratory Astrophysics Experiments,” Proceeding of SIAM Annual Meeting, 2006.83. J. Glimm, H. Jin, and Y. Zhang, “Front Tracking for Multiphase Fluid Mixing,” Proceeding of Division of Fluid Dynamics 56th Annual Meeting, KB.008, American Physical Society, 2003. Non-Refereed Papers, Report and Other Articles:84. J. Glimm, X. Li, and Y. Zhang, “Modeling and Simulation of Fluid Mixing Laser Experiments and Supernova,” National Nuclear Security Administration Progress Report, Award Number: DEFGS206NA 26208, 2007.85. J. Glimm and Y. Zhang, “Laser Fusion and Turbulent Mixing”, Advanced Energy Research and Technology, Page 5, 2006.86. Y. Zhang, J. Glimm, S. Dutta, and P. Lavergne, “Interface Tracking for Reactive Flows with Application to Type Ia Supernova,” Preprint, 2006.87. R. P. Drake, Y. Zhang, and etc., “Experimental Astrophysics on Omega Laser,” National Nuclear Security Administration Final Report, Award Number: DEFG5203SF22689, 2005.88. S. Dutta, J. Glimm, and Y. Zhang, “LES Simulations of Turbulent Combustion in a Type Ia Supernova,” University at Stony Brook preprint number AMS-05-05, 2005.89. Y. Zhang, R. P. Drake, J. Glimm, and P. Lavergne, “Numerical Measurement of Impact of Laser Preheat on Interface Structure and Instability,” University at Stony Brook Report, AMS-03-13, 2004.90. J. Glimm, J. Grove, and Y. Zhang, “Numerical Calculation of Rayleigh-Taylor and Richtmyer-Meshkov Instabilities for Three Dimensional Axisymmetric flows in Cylindrical and Spherical Geometries,” Los Alamos Laboratory, Report# LA-UR99-6796, 1999.

其他成果:荣誉与学术奖励:浙江省“钱江学者”特聘教授(2013)浙江省“特聘专家”称号(2012)浙江省科学技术奖(2012)浙江省高校重点学科“全球金融管理”学科带头人(2012)中国教育部“海外高层次人才”称号(2010)江苏省“青蓝工程”学术带头人(2010)美国名人录(2010-至今)美国国家科学基金会天体物理奖(2005)美国纽约州立大学个人发展奖(2005,2006)第四届世界非线性大会主讲人(2004)美国工程教育名人录(2002-至今)浙江省宁波市海曙区人民政府科技顾问(2000-至今)美国第十一届数学年会杰出论文奖(1995)美国芝加哥大学学院学者奖学金(1991-1992)美国芝加哥大学大学学者奖学金(1990-1991)香港王宽诚基金奖学金(1990)法国UAP数学奖(1989)

科研项目:2017.01-2021.12,宁波市海外高层次人才和高端创业创新团队(3315计划),2000万元。2016/01-2018/12,主持质谱现场离子源电离机理的研究(61501273),国家自然科学基金项目。2012/01-2015/12 三重四级杆串联质谱系统的研制及其痕量有机物分析中的应用(“十二五”国家重大科技专项,基金号,2011YQ060084,项目总经费4155万),主持子课题2项,(编号:2011YQ0600840602,204万)和(编号:2011YQ0600840702,226万)。

[教育背景]

以上老师的信息来源于学校网站,如有更新或错误,请联系我们进行更新或删除,联系方式

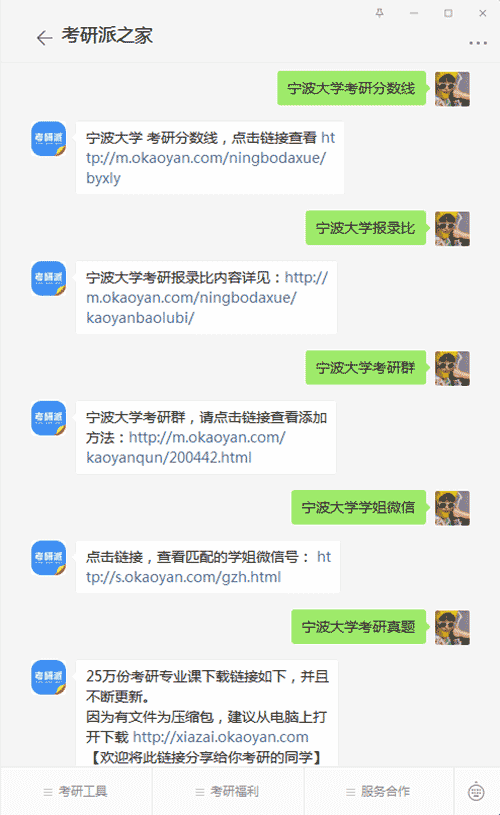

添加宁波大学学姐微信,或微信搜索公众号“考研派小站”,关注[考研派小站]微信公众号,在考研派小站微信号输入[宁波大学考研分数线、宁波大学报录比、宁波大学考研群、宁波大学学姐微信、宁波大学考研真题、宁波大学专业目录、宁波大学排名、宁波大学保研、宁波大学公众号、宁波大学研究生招生)]即可在手机上查看相对应宁波大学考研信息或资源。

宁波大学

本文来源:http://www.okaoyan.com/ningbodaxue/yanjiushengdaoshi_529391.html